How Does a Stock Split Work for ETFs?

What ETF Investors Need to Know About Stock Splits + SCHD Recent Split👇

A stock split is a common corporate action that can affect individual stocks, but what happens when it comes to ETFs?

In this article, we'll delve into the world of ETFs and explore how stock splits work for these popular investment vehicles.

What is a Stock Split?

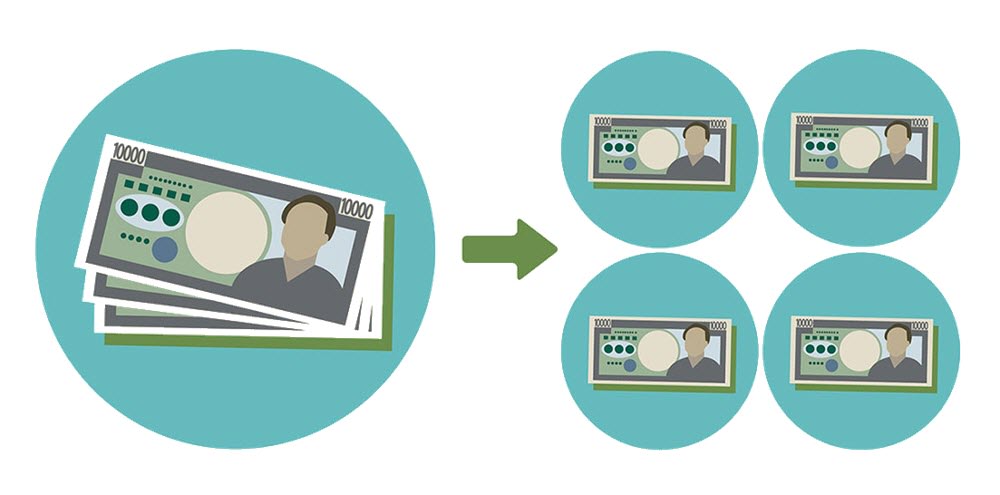

A stock split, is a corporate action where a company divides its existing shares into a larger number of new shares. This is typically done to make the stock more affordable and attractive to investors.

For example, if a company declares a 2-for-1 stock split, each existing shareholder will receive two new shares for every one share they currently own.

How Do Stock Splits Affect ETFs?

When a stock split occurs, here’s what happens:

No Action Required: ETF investors do not need to take any action when a stock split occurs. The ETF's management team will automatically adjust the fund's holdings to reflect the split.

No Change in Value: A stock split does not change the underlying value of the ETF. The total value of the ETF's holdings remains the same, but the number of shares and the price per share will adjust to reflect the split.

Example: SCHD’s Recent Stock Split

Schwab's U.S. Dividend Equity ETF SCHD 0.00%↑ underwent a 3-for-1 stock split on October 11th, making it more accessible to individual investors. Here's a breakdown of the split and its implications:

New Price: SCHD's new price per share is approximately $28.34, down from $85.02 pre-split, as of October 11th, 2024.

No Change in Value: The split does not affect the overall value of current investors' holdings. Shareholders will now own three times as many shares, but the total investment value remains the same.

Example: If you held 100 shares worth $8,502 pre-split, you would now have 300 shares, with the same total investment value, $8,502.

Increased Accessibility: The lower price per share makes SCHD more attractive to cost-conscious investors who prefer to buy full shares rather than fractional ones.

Key Takeaways

The 3-for-1 stock split does not change the fundamental value of SCHD.

Current investors will own more shares, but the total investment value remains the same.

Why do Stock Splits Occur?

Attract more investors: By making the stock more affordable, a stock split can attract more investors who may be more likely to invest in a stock with a lower price.

Anchoring bias: Investors might be fixated on the pre-split price, thinking the post-split price is a "better value."

Conclusion

As an ETF investor, you do not need to take any action when a stock split occurs, and the value of your investment will not be affected. By understanding how stock splits work for ETFs, you can continue to invest with confidence in these popular investment vehicles.

If you are interested in viewing my live ETF portfolio, download Blossom Social here, and follow my profile, etf.investments 🤓 (Only available in the US and Canada)